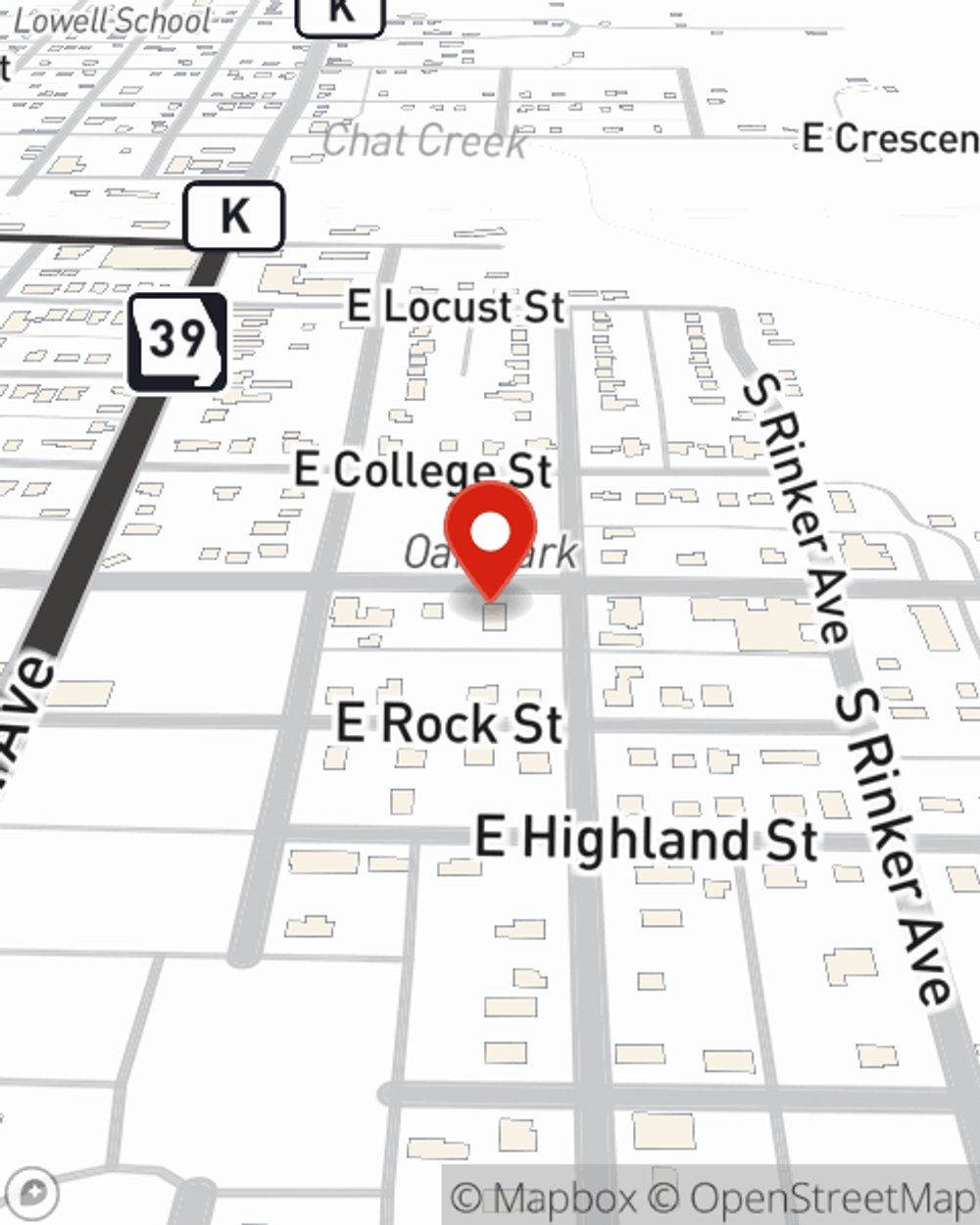

Condo Insurance in and around Aurora

Looking for great condo unitowners insurance in Aurora?

Quality coverage for your condo and belongings inside

- Aurora

- Marionville

- Crane

- Verona

- Shell Knob

Condo Sweet Condo Starts With State Farm

When considering different deductibles, coverage options, and providers for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo unit but also your personal belongings within, including sports equipment, linens, mementos, and more.

Looking for great condo unitowners insurance in Aurora?

Quality coverage for your condo and belongings inside

Agent Shane Parker, At Your Service

When a tornado, fire or an ice storm cause unexpected damage to your condominium or someone hurts themselves on your property, having the right coverage is necessary. That's why State Farm offers such great condo unitowners insurance.

There is no better time than the present to contact agent Shane Parker and ask any questions you may have about your condo unitowners insurance options. Shane Parker would love to help you choose the right level of coverage.

Have More Questions About Condo Unitowners Insurance?

Call Shane at (417) 678-5072 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.

Shane Parker

State Farm® Insurance AgentSimple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

Should you DIY your move or hire someone?

Should you DIY your move or hire someone?

Moves can vary in price — and effort. We walk you through your options, from DIY to full-service professional movers, and provide recommendations for when to opt for each.